child tax credit for december 2021 how much

The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old.

The 2021 Child Tax Credit Information About Payments Eligibility

Child Tax Credit 2021.

. For 2021 eligible parents or guardians. A couple that makes about 100000 with two qualifying children under the age of six can expect to receive 7200 under the new plan. Under the new law the credit is fully refundable meaning families who owe little or no federal tax will get a check for the full amount.

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax. The Child Tax Credit is intended to offset the many expenses of raising children.

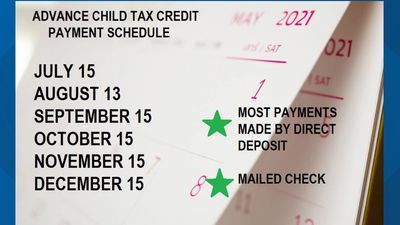

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The payment schedule would look like this. For Tax Years 2018-2020.

Up to 35 of 3000 1050 of child care expenses for a. A childs age determines the amount. How much money will families have received from Child Tax Credit by December 2021.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The enhanced child tax credit increased from 2000 to 3000 per child 17 and under and 3600 for kids under age six for the 2021 tax year. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in.

It has gone from 2000 per child in 2020 to 3600 for. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021.

They would be eligible to receive 3600 in. Beginning in July 2021 payments are to be. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

For tax year 2022 the Child and Dependent Care Credit adjusts back to the pre-2021 provision and changes back to. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. It helped roughly 60 million children and helped cut child.

The final payment for the child tax credit will be made on 15 December. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. If they end up making payments once per month July - December that would mean youll receive 300 per month.

The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families.

One Remaining Child Tax Credit Payment For 2021 Make Sure You Re Enrolled For 2022 Wkrc

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

The Child Tax Credit The White House

Child Tax Credit Payment Schedule For 2021 Kiplinger

First Phase Ending For Child Tax Credit A Game Changer For Families

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Some Families Will Get 1 800 Per Child In Child Tax Credits In December Are You Eligible The Us Sun

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Youtube

Child Tax Credit Update Next Payment Coming On November 15 Marca

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All The Us Sun

File Us Child Tax Credit Build Back Better Act Png Wikipedia

3 7 Million More Kids Are In Poverty Without The Monthly Child Tax Credit Study Says Npr

Families Will Soon Receive Their December Advance Child Tax Credit Payment