mississippi income tax forms

Renew Your Driver License. And you ARE NOT ENCLOSING A PAYMENT then use this address.

Fill Free Fillable Forms For The State Of Mississippi

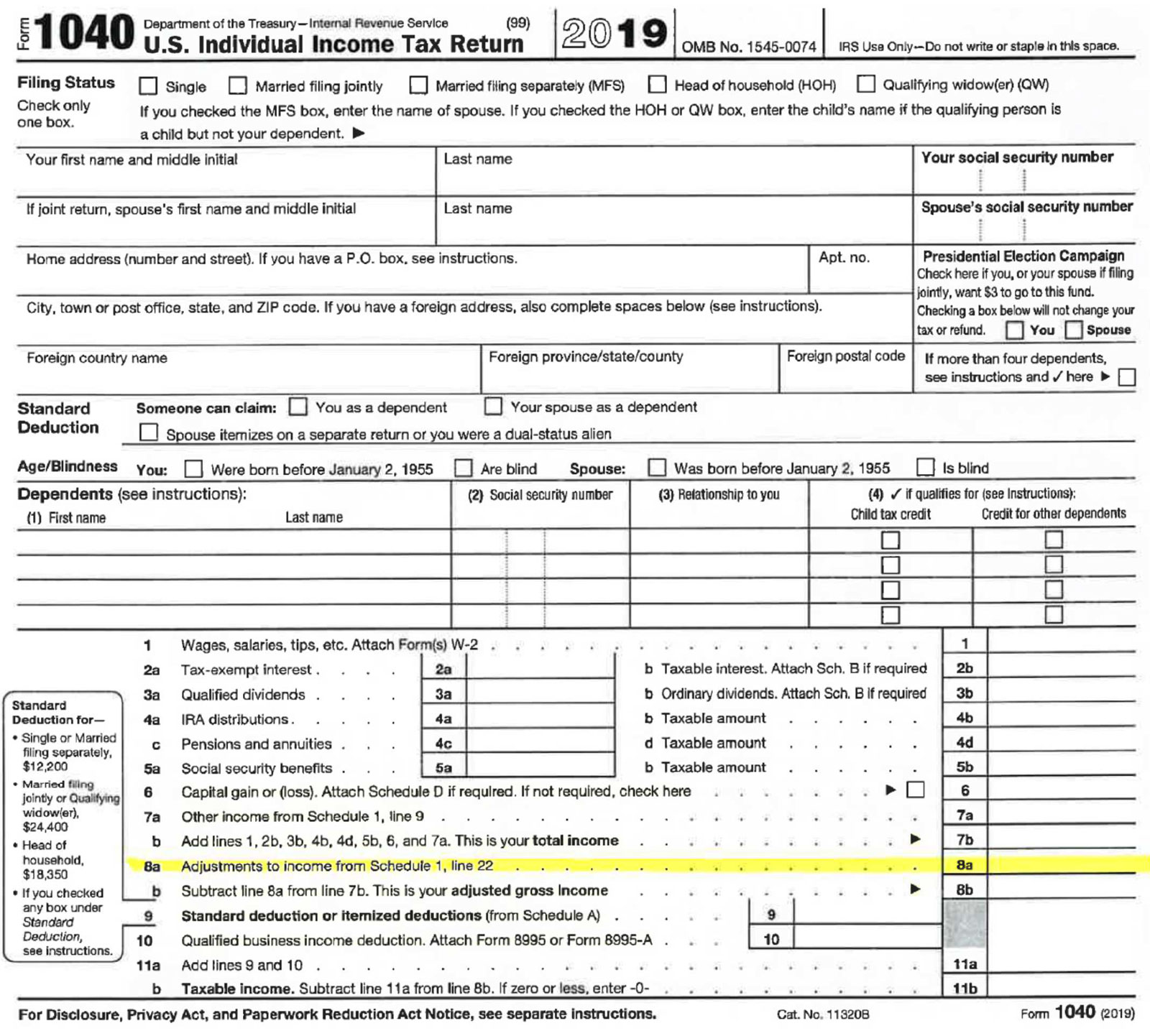

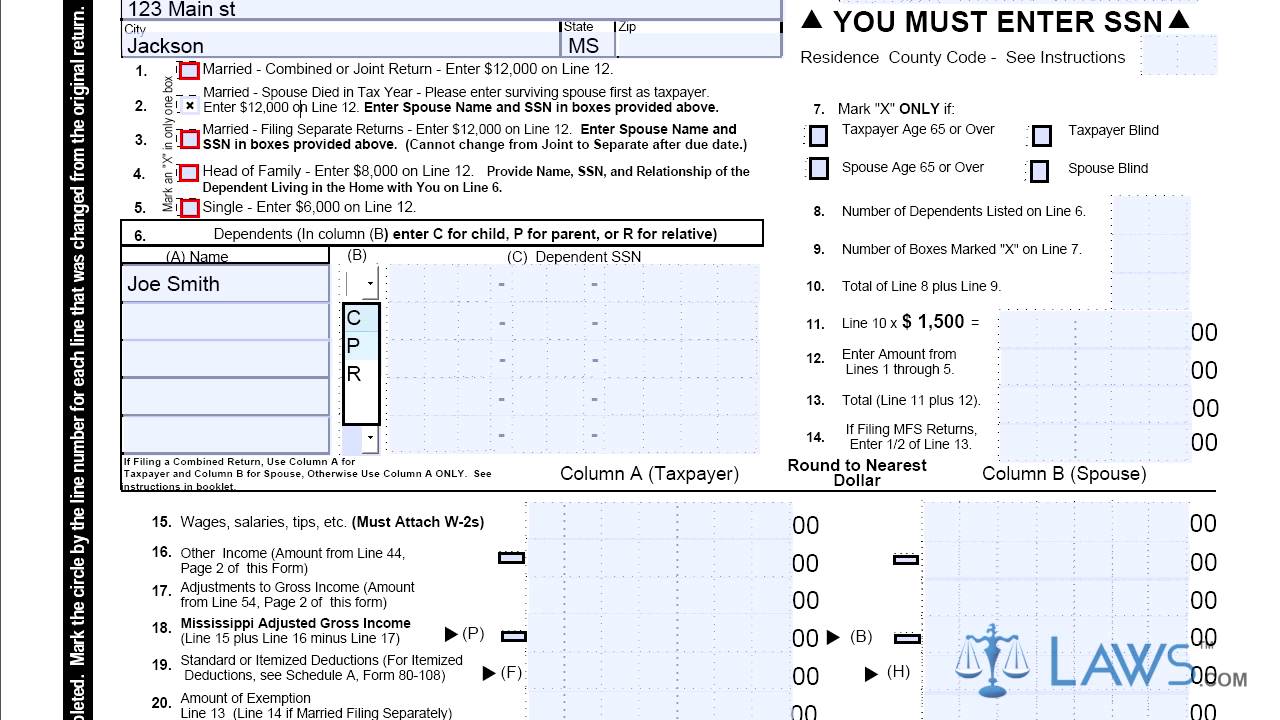

Form 80-105 requires you to list multiple forms of income such as wages interest or alimony.

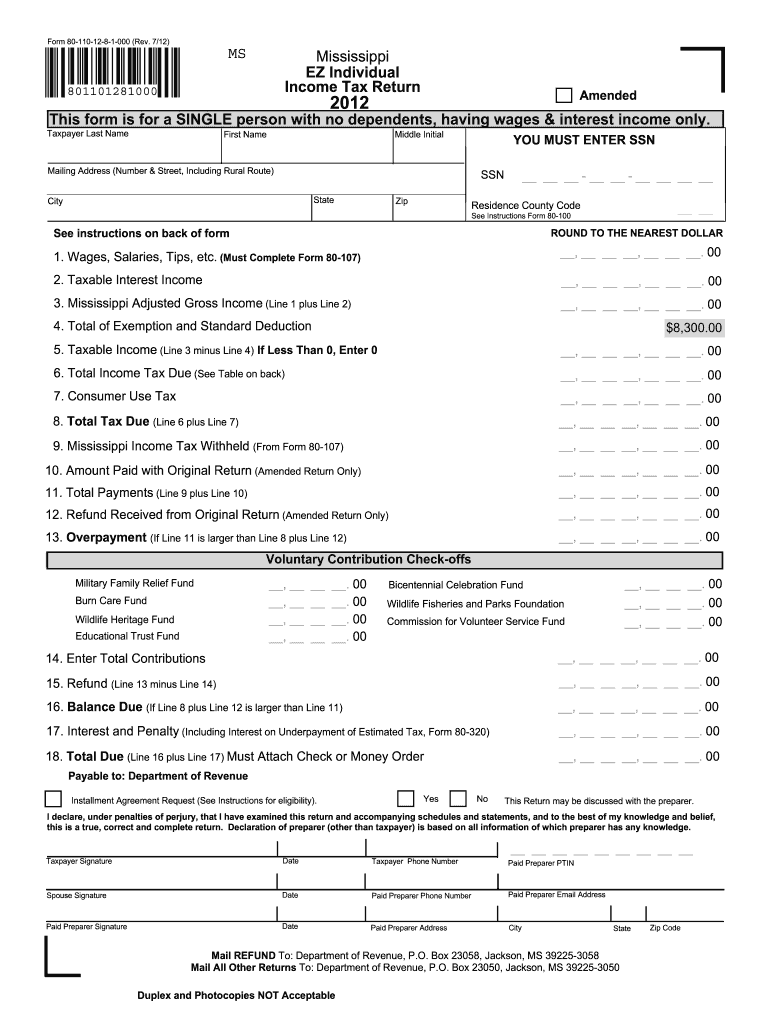

. E-File Directly to the IRS State. Welcome to The Mississippi Department of Revenue. Form 80-105 is the general individual income tax form for Mississippi residents.

Mississippis income tax ranges between 3 and 5. Most states will release updated tax forms between January and April. Ad Free 2021 Federal Tax Return.

To comply with the Military Spouse Residency Relief Act PL111-97 signed into law. If you live in MISSISSIPPI. Form 80-100-21-1-1-000 Rev821 RESIDENT NON-RESIDENT AND PART-YEAR RESIDENT 2021 INCOME TAX INSTRUCTIONS INDIVIDUAL INCOME TAX BUREAU PO BOX 1033 JACKSON MS 39215-1033 WWWDORMSGOV fTABLE OF CONTENTS WHATS NEW.

These back taxes forms can not longer be e-Filed. Many states have separate versions of their tax returns for nonresidents or part-year residents - that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year. If someone makes more than 10000 they pay a maximum of 5.

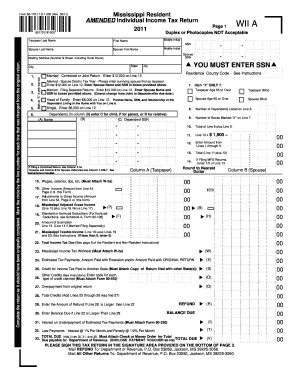

Mississippi has a state income tax that ranges between 3 and 5 which. And you are filing a Form. 23 Total Mississippi income tax due line 20 plus line 21 and line 22 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return.

The Department of Revenue is responsible for titling. Mississippi Income Withholding Tax Schedule 2021 Duplex and Photocopies NOT Acceptable 801072181000 Form 80-107-21-8-1-000 Rev. 3 LEGISLATIVE CHANGES REMINDERS 3 3 FILING REQUIREMENTS.

Individual Income Tax Instructions. This website provides information about the various taxes administered access to online filing and forms. Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

You need to file form 80-300 with the Mississippi Department. Purchase Hunting Fishing License. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face.

These nonresident returns allow taxpayers to specify. The current tax year is 2020 and most states will release updated tax forms between January and April of 2021. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

Mississippi state income tax Form 80-105 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Below are forms for prior Tax Years starting with 2020. Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to.

And you ARE ENCLOSING A PAYMENT then use this address. Details on how to only prepare and print a Mississippi 2021 Tax Return. The current tax year is 2021 with tax returns due in April 2022.

42 Interest income from Form 80-108 part II line 3 43 Dividend income from Form 80-108 part II line 6 39 Capital gain. Department of Revenue - State Tax Forms. Box 23050 Jackson MS 39225-3050.

You may also want to visit the Federal income tax forms page. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. Box 22781 Jackson MS 39225-2781.

Department of the Treasury Internal Revenue Service Austin TX. Form 80-105 is the general individual income tax form for Mississippi residents. Form 80-106 - Payment Voucher.

We last updated Mississippi Form 80-108 in January 2022 from the Mississippi Department of Revenue. Mississippi Department of Employment Security Tax Department PO. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

0621 Mississippi Income Withholding Tax Schedule 2021 801072181000 Reset Form Print Form Primary Taxpayer Name as shown on Forms 80-105 80-205 and 81-110 THIS FORM MUST BE FILED EVEN IF YOU HAVE NO MISSISSIPPI WITHHOLDING A - Statement Information B -. This form is for income earned in tax year 2021 with tax returns due in April 2022. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

All other income tax returns P. If someone makes less than 5000 they pay a minimum of 3. 819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE.

If you are receiving a refund PO. The rate increases with income in between. You must file online or through the mail yearly by April 17.

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. We will update this page with a new version of the form for 2023 as soon as it is made available by the Mississippi.

You may file your Form 80-105 with paper forms through the mail or online with efiling. Form 80-205 is a Mississippi Individual Income Tax form. Form 80-105 is the general individual income tax form for Mississippi residents.

Mississippi Income Tax Forms. Download the Employer Change Request form. Income and Withholding Tax Schedule 80107218pdf Form 80-107-21-8-1-000 Rev.

Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return. The state uses a simple formula to determine how much someone owes. Vital Records Request.

EMPLOYER INCOME TAX MUST BE WITHHELD BY THE EMPLOYER ON TOTAL 7. Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of RevenueTaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms. 0621 Primary Taxpayer Name as shown on Forms 80-105 80-205 and 81-110 A - Statement Information B - Income and Withhholding C - Employer or Payer Information.

Box 23058 Jackson MS 39225-3058. Locate Your Tax Refund. 19 rows 37 PDFS.

You must file online or through the mail yearly by April 17. More about the Mississippi Form 80-108. You must file online or through the mail yearly by April 17.

A downloadable PDF list of all available Individual Income Tax Forms.

Pff2 Form Fill Online Printable Fillable Blank Pdffiller

Mississippi Return Review Notice Sample 1

Maine Tax Forms And Instructions For 2021 Form 1040me

Individual Income Tax Forms Dor

Where S My State Refund Track Your Refund In Every State Taxact Blog

How To Fill Out Mississippi Withholding Form Fill Online Printable Fillable Blank Pdffiller

Printable Mississippi Income Tax Forms For Tax Year 2021

Fill Free Fillable Forms For The State Of Mississippi

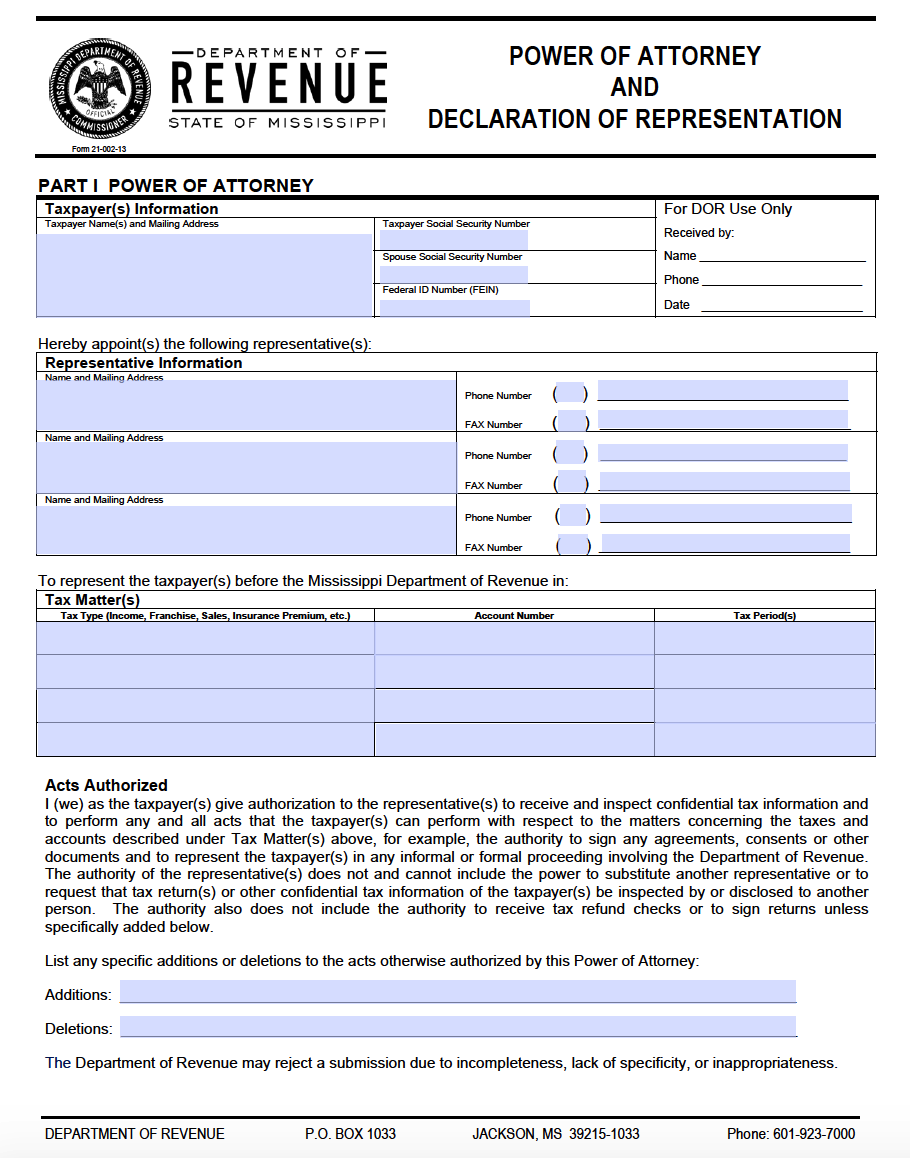

Free Mississippi Power Of Attorney Forms Pdf Templates

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

Form 80 170 Mississippi Resident Amended Individual Income Tax Return Youtube

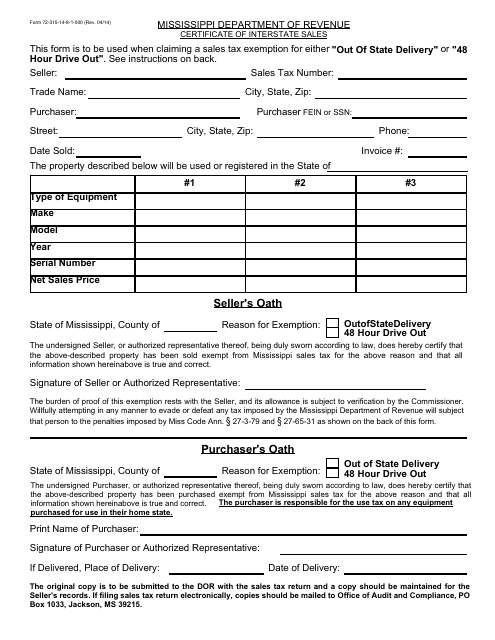

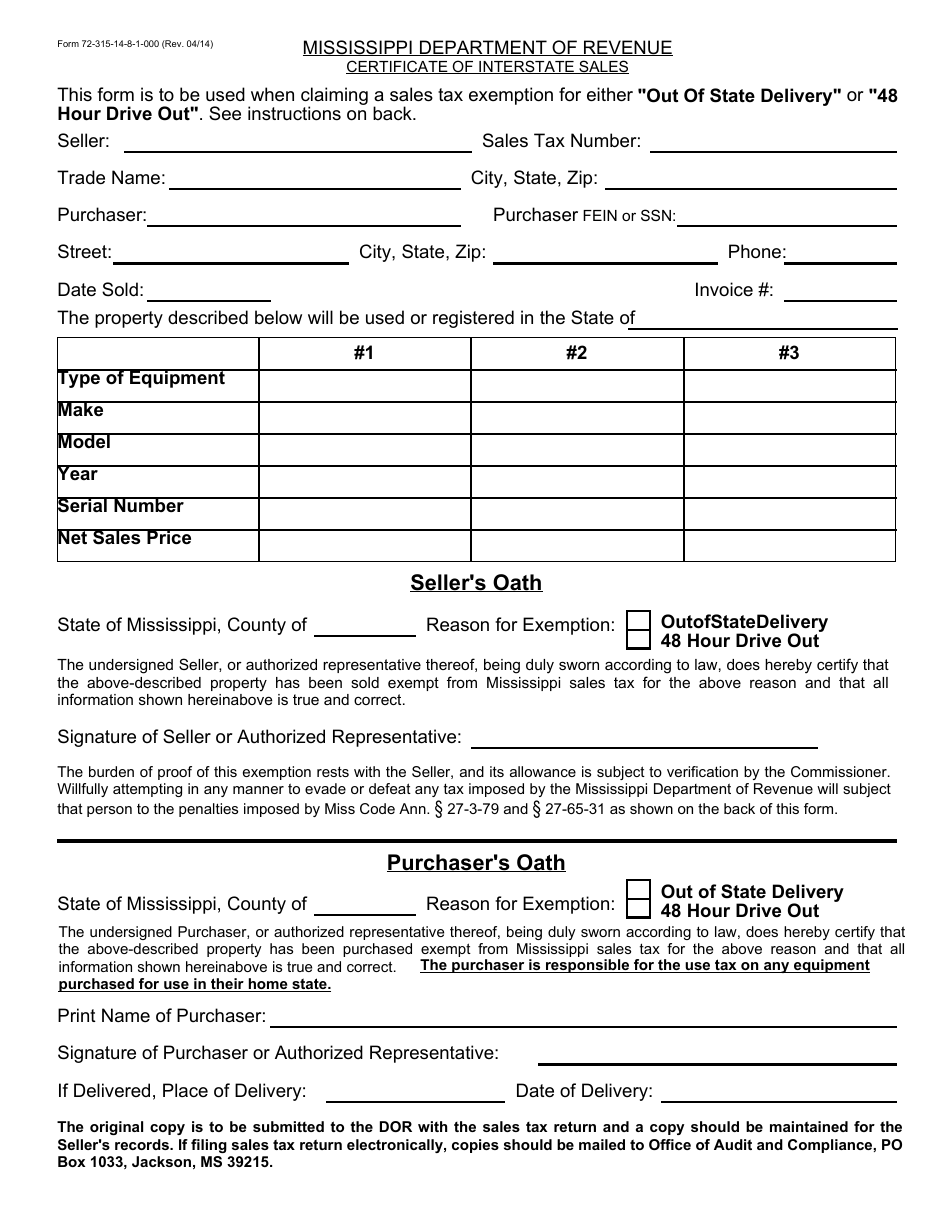

Form 72 315 14 8 1 000 Download Printable Pdf Or Fill Online Certificate Of Interstate Sales Mississippi Templateroller

1098 T And 1042 S Tax Documents Technews Technews

Individual Income Tax Forms Dor

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

Form 72 315 14 8 1 000 Download Printable Pdf Or Fill Online Certificate Of Interstate Sales Mississippi Templateroller